irs unveils federal income tax brackets for 2022

Democrat Billionaire Mike Bloomberg Pays Less than Half the Tax Rate Paid by Average American. 51 Agricultural Employers Tax Guide.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

. However the tax bracketsare adjusted or indexed each year to. As a result taxpayers with taxable income of 523600 or more for. 15 Employers Tax Guide and Pub.

November 12th 2021 under General News Law Enforcement News PeruRegional. Your bracket depends on your taxable income and filing status. Thursday March 10 2022.

Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022. This revenue ruling provides various prescribed rates for federal income tax purposes for May 2022 the current month. There are seven federal tax brackets for the 2021 tax year.

In addition beginning in 2018 the tax. 2022 Federal Income Tax Brackets And Rates In 2022 The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows Table 1. 10 12 22 24 32 35 and 37.

Married Filing Jointly or Qualifying Widower Married Filing Separately. This publication supplements Pub. Married couples filing jointly.

Your 2021 Tax Bracket to See Whats Been Adjusted. Irs unveils federal income tax brackets for 2022. Discover Helpful Information and Resources on Taxes From AARP.

For most people tax rates were reduced. Returns with Positive 1979 Income Concept Income - The 1979 Income Concept was developed to provide a more uniform measure of income across tax years. The tax rateshavent changed since 2018.

Jan 18 2022 The rate is increased for each dependent child and also if the surviving spouse is. 9 rows As was the case and due to Trumps Tax Cuts and Jobs Acts the the personal exemption remained 0. There are seven federal income tax rates in 2022.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. It describes how to figure withholding using the Wage. Since the 2018 tax year tax brackets have been set at 10 12 22 24 32 35 and 37.

Ad Compare Your 2022 Tax Bracket vs. The IRS also announced that the standard deduction for 2022 was increased to the following. Income limits for all tax brackets and filers will be modified for inflation in 2021 as stated in the tables below.

For 2022 theyre still set at 10 12 22 24 32 35 and 37. These are the rates for. 25900 Single taxpayers and married individuals filing.

Table 1 contains the short-term mid-term and long-term applicable. Breitbart Politics by John Binder Original Article.

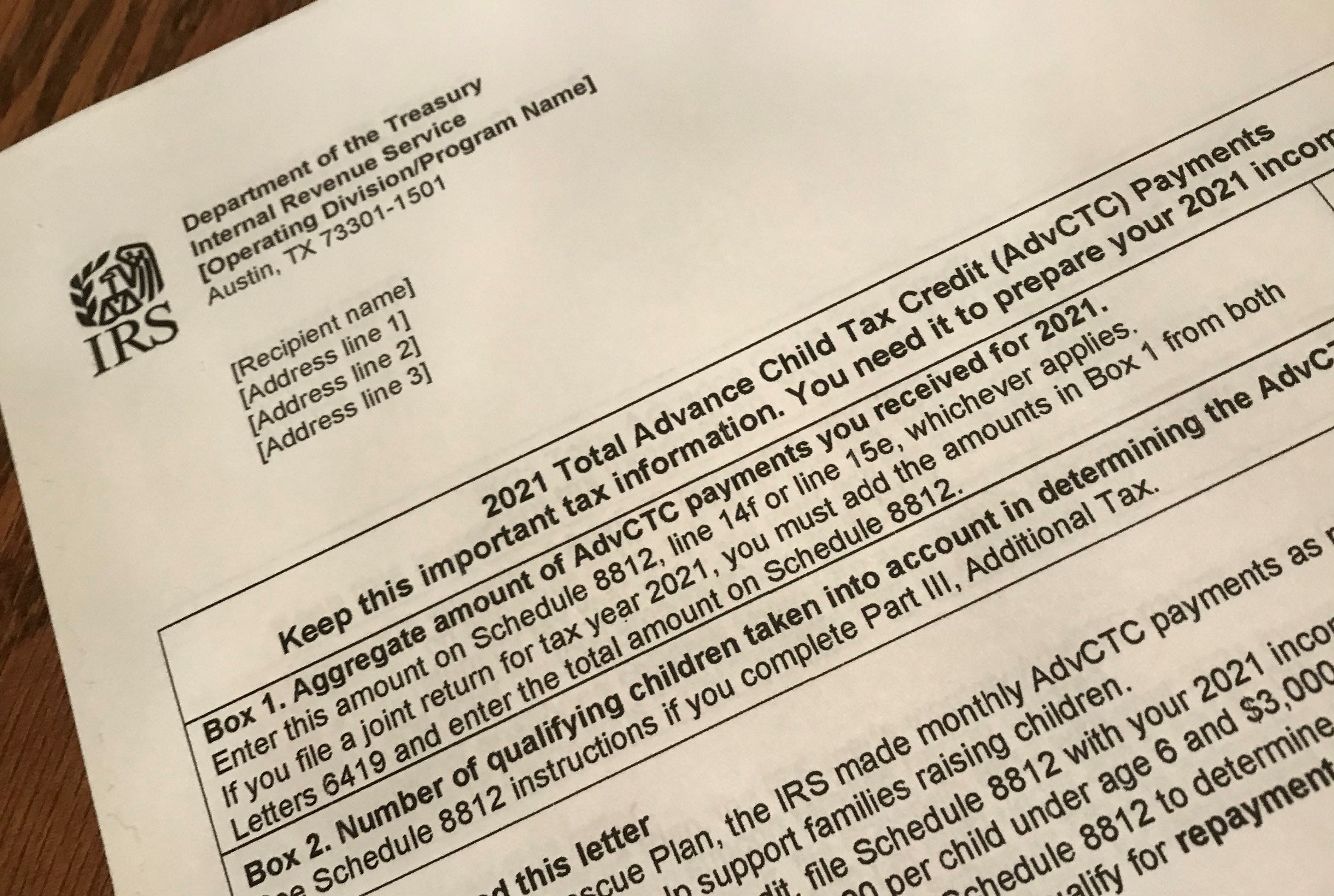

Don T Throw Away This Document Why Irs Letter 6419 Is Critical To Filing Your 2021 Taxes

Tax Season 2022 How Much Is The Tax Payment Per Child For This Year Marca

Growing Stress For Taxpayers And Irs Alike As Agency Warns Of Severe Understaffing This Tax Season Cbs News

Richest Americans Including Bezos Musk And Buffett Paid Federal Income Taxes Equaling Just 3 4 Of 401 Billion In New Wealth Bombshell Report Shows

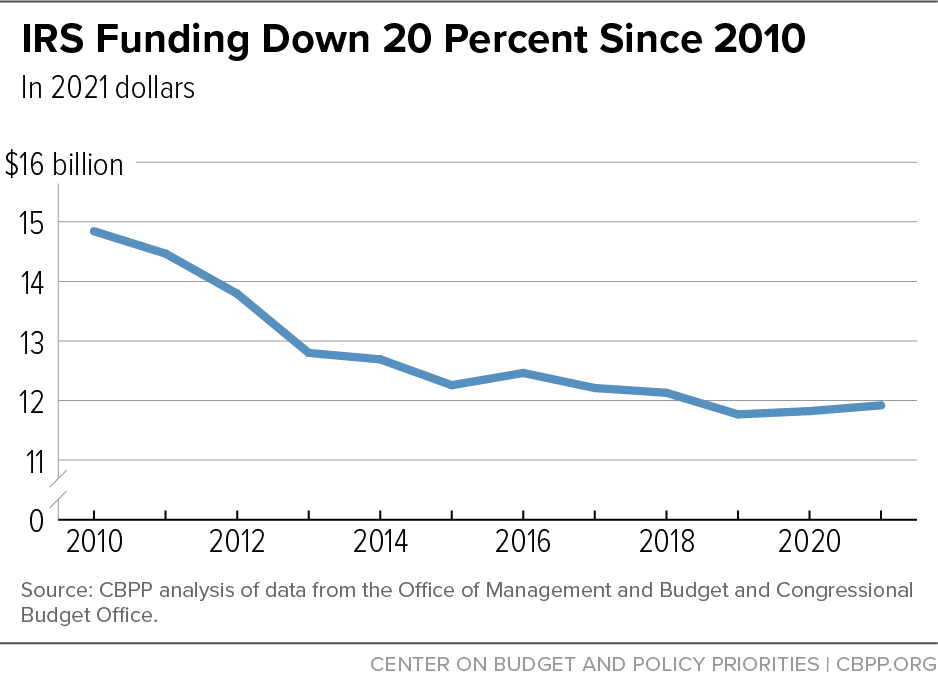

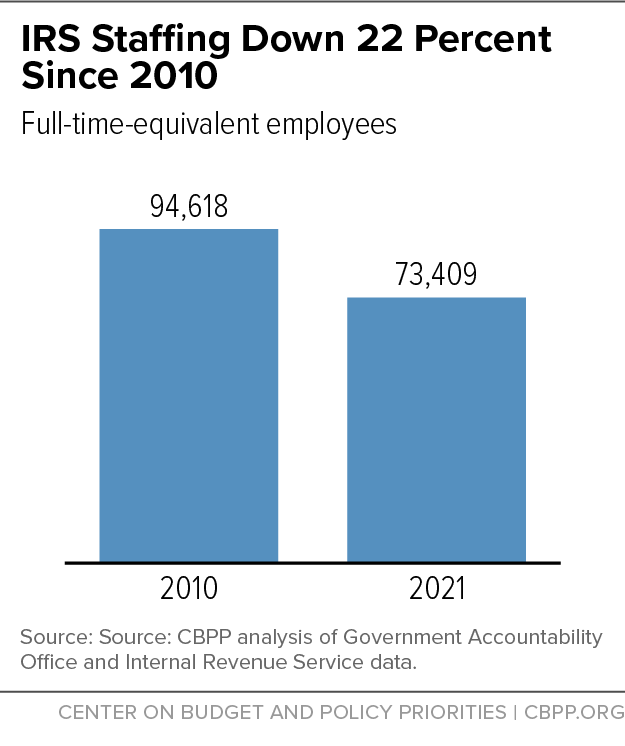

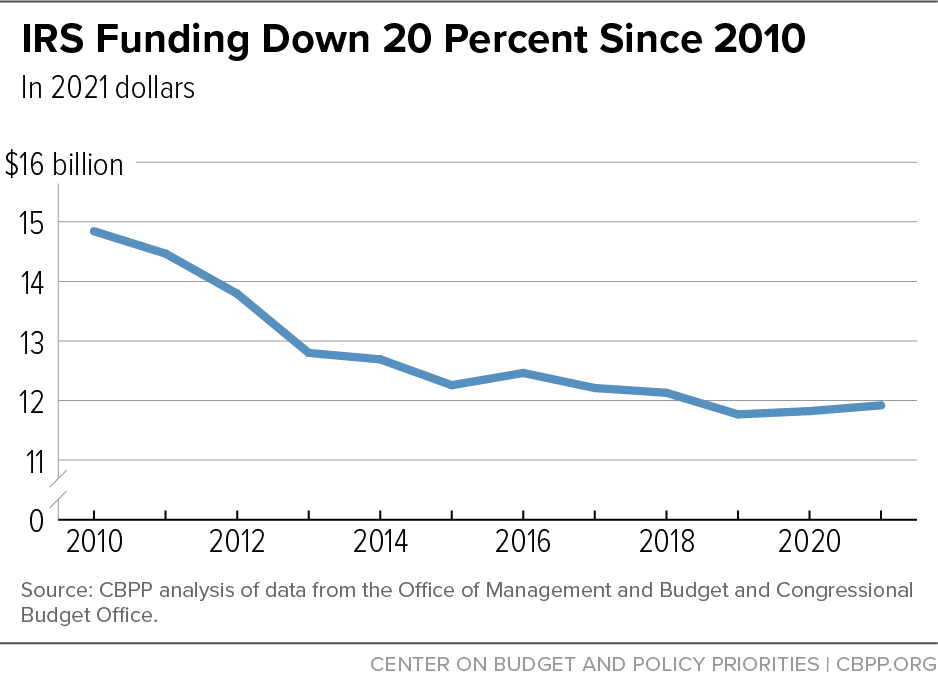

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

President Biden To Unveil New 20 Minimum Billionaire Tax In 2023 Budget Gobankingrates

Everything To Know About How Biden Wants To Change The Corporate Tax Code Fortune

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

Biden Tax Plan Would Target Corporations Multi Millionaires And Boost Irs Funding The Washington Post

Billionaires Income Tax What S In The Senate Democratic Plan Npr

Tax Season Begins Two Weeks Early Due To Virus Irs Funding Political News Us News

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Irs Announces Standard Tax Deduction Increase For Tax Year 2022 To Adjust For Inflation

Child Tax Credits Irs Unveils New Income Tool That Could Lead To Bigger Or Smaller Payments

Biden Moves To Campaign Mode With Billionaire Tax Plan The Hill

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Explainer How To Get Up To 3 600 Per Child In Tax Credit Business News Us News

Congress Needs To Take Two Steps To Fund The Irs For The Short And Long Term Center On Budget And Policy Priorities

Higher Tax Rates For Billionaires And Corporations Can Still Fund Biden S Agenda